Discover Wyoming Federal Credit Union: Your Trusted Financial Partner

Open the Benefits of a Federal Lending Institution Today

Discover the untapped benefits of lining up with a federal credit report union, a calculated financial move that can reinvent your financial experience. From exclusive member advantages to a strong neighborhood principles, government lending institution provide a distinctive strategy to monetary solutions that is both economically valuable and customer-centric. Discover how this alternate banking version can offer you with an unique point of view on economic wellness and lasting security.

Benefits of Joining a Federal Credit History Union

One of the key benefits of signing up with a Federal Credit rating Union is the focus on member fulfillment rather than creating profits for shareholders. Additionally, Federal Debt Unions are not-for-profit companies, enabling them to use affordable rate of interest rates on savings accounts, lendings, and credit history cards (Credit Unions Cheyenne).

Another benefit of signing up with a Federal Credit score Union is the sense of neighborhood and belonging that participants often experience. Federal Credit score Unions commonly supply economic education and resources to help participants improve their financial literacy and make notified decisions regarding their money.

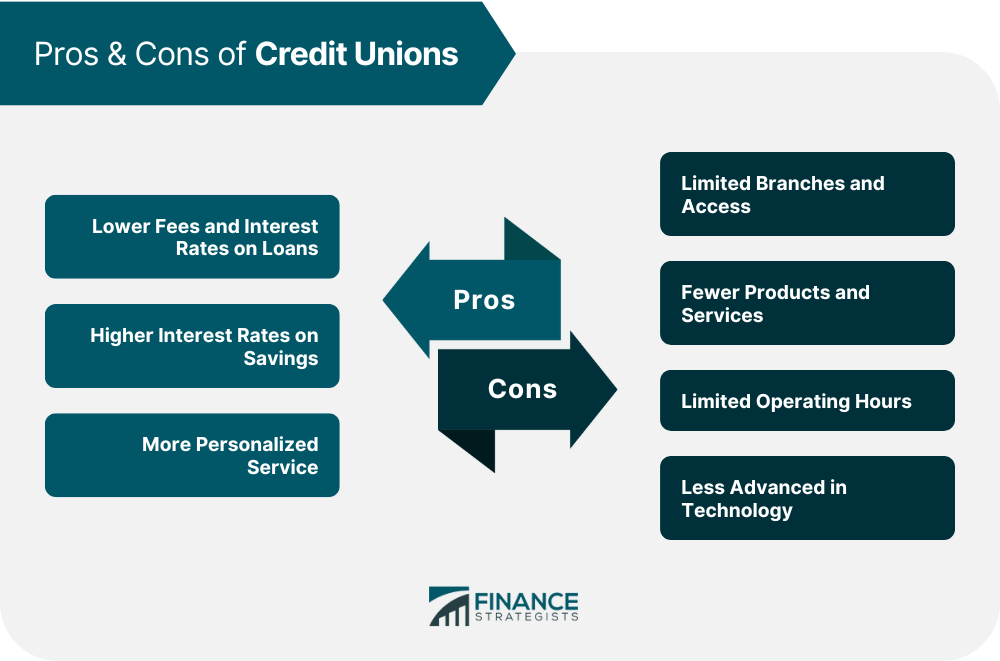

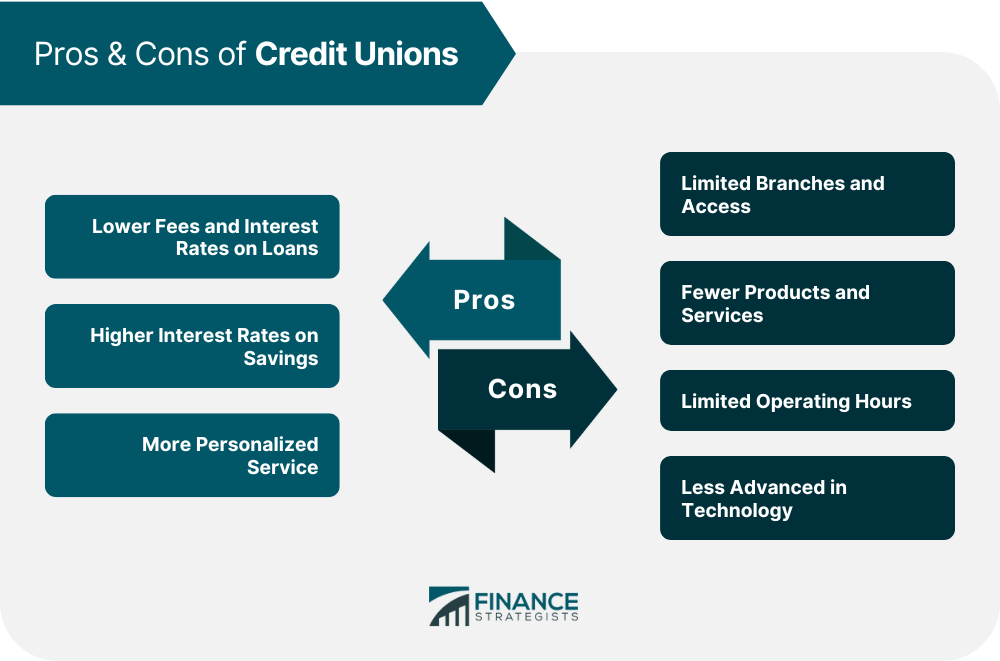

Reduced Charges and Affordable Prices

Furthermore, federal credit history unions are understood for offering competitive rate of interest rates on cost savings accounts, fundings, and credit rating cards. By supplying these competitive prices, government credit unions focus on the monetary health of their members and strive to help them accomplish their financial objectives.

Individualized Customer Support

A characteristic of federal cooperative credit union is their dedication to giving personalized client service tailored to the individual demands and preferences of their members. Unlike typical banks, government lending institution focus on developing solid partnerships with their members, intending to supply an extra customized experience. This individualized approach indicates that members are not simply viewed as an account number, however instead as valued people with one-of-a-kind monetary objectives and situations.

One method government lending institution provide individualized customer support is via their member-focused approach. Reps put in the time to understand each member's particular financial circumstance and deal customized solutions to satisfy their requirements. Whether a participant is aiming to open a new account, look for a finance, or look for economic recommendations, federal debt unions make every effort to provide tailored advice and support every step of the method.

Community-Focused Initiatives

To better improve their influence and connection with participants, government credit report unions actively engage in community-focused initiatives that add to the wellness and growth of the areas they serve. These campaigns often consist of monetary education and learning programs focused on encouraging people with the understanding and skills to make educated choices regarding their finances (Cheyenne Credit Unions). By supplying workshops, seminars, and individually counseling sessions, cooperative credit union help area participants enhance their financial literacy, manage financial debt effectively, and prepare for a protected future

In addition, federal lending institution often join local events, sponsor community jobs, and assistance philanthropic reasons to address particular requirements within their service areas. Going Here This participation not just shows my sources their commitment to social duty yet also reinforces their relationships with members and fosters a sense of belonging within the area.

Through these community-focused campaigns, government lending institution play a vital role in advertising monetary incorporation, financial security, and total success in the regions they operate, ultimately creating a positive effect that extends past their typical banking solutions.

Optimizing Your Subscription Benefits

When aiming to take advantage of your subscription benefits at a lending institution, understanding the range of services and sources readily available can considerably enhance your financial wellness. Federal lending institution supply a series of benefits to their members, including affordable rate of interest on cost savings accounts and fundings, reduced charges compared to standard financial institutions, and customized customer service. By maximizing these advantages, members can boost their monetary security and attain their objectives much more efficiently.

Furthermore, participating in economic education and learning programs and workshops offered by the debt union can assist you enhance your cash monitoring skills and make even more educated decisions regarding your financial future. By actively involving with the resources readily available to you as a member, you can open the full capacity of your partnership with the credit scores union.

Verdict

To conclude, the benefits of signing up with a federal credit score union include reduced costs, affordable prices, customized client service, and community-focused campaigns. By maximizing your membership benefits, you can access expense financial savings, customized remedies, and a sense of belonging. Take into consideration opening the benefits of a federal credit scores union today to experience a banks that focuses on participant contentment and supplies a range of resources for financial his response education.

Furthermore, Federal Credit score Unions are not-for-profit companies, enabling them to supply affordable rate of interest prices on financial savings accounts, loans, and credit rating cards.

Federal Credit history Unions usually give monetary education and learning and resources to aid participants improve their monetary literacy and make educated decisions regarding their money.